Hello everyone,

There’s been a lot of activity from the world’s financial regulators on mandating carbon emission disclosures for businesses. For those that missed it, in March the US SEC submitted a draft rule mandating disclosure of climate-related risks, including Scope 3 emissions.

That means for investors who manage funds, your portfolio carbon footprints (i.e. financed emissions) will need to be calculated and disclosed. Beyond government mandates, portfolio carbon footprints are the critical first step for investors to understand financial risk and reward as the world moves to net-zero.

So how can you calculate the carbon footprint of a portfolio? And what are best practices? In this newsletter, I wanted to provide a helpful guide to allow any portfolio manager to easily calculate their carbon footprint and understand what it means.

Explainer: What are financed emissions?

The Taskforce for Climate-related Financial Disclosures (TCFD) is clear on adopting an equity ownership approach for financed emissions. The higher equity percentage holding, the more emissions the investor ‘owns’. For disclosure purposes however, what type of emissions are those ‘financed emissions’?

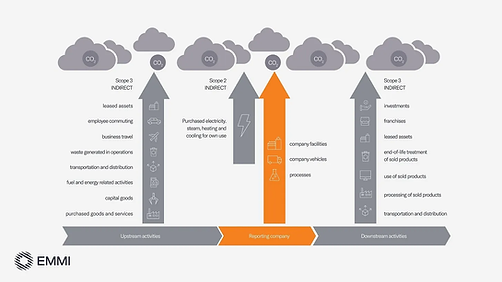

Carbon disclosure reporting is guided by the GHG Protocol which divides greenhouse gas emissions into three scopes:

- Scope 1 emissions are emissions which come directly from a company and it’s controlled entities

- Scope 2 emissions come from the generation of purchased energy

- Scope 3 emissions are all indirect (value chain) emissions - like your investments or how customers use a product

Financed emissions are defined as Scope 3 emissions under the GHG protocol, however most financial institutions are unaware of its magnitude.

A recent analysis from the Carbon Disclosure Project (CDP) estimated that on average, only 25% of financial institutions report their Scope 3 financed emissions. Meanwhile, those Scope 3 financed emissions are over 700x larger than reported Scope 1 & 2 emissions for financial institutions.

So as the starting point for any multi-asset portfolio, how do you calculate this for equities?

Step 1: Source company-level emissions for your portfolio

You will need to source carbon emissions data for the companies you invest in. If you have private companies, you can ask them directly and for public companies, you can do this yourself with some research. And for those companies that have never reported emissions, you can use our predictive models at Emmi.

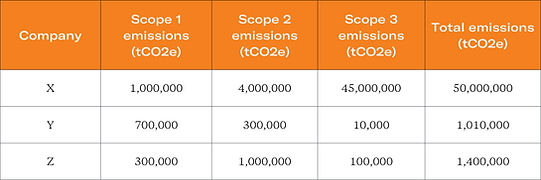

If you don’t have many companies in your portfolio, a simple way to source publicly disclosed information yourself is to look at each company’s annual and/or sustainability reports. For example, BHP has a detailed report online. Using a spreadsheet like the example below, you can manually add the Scope 1, 2 and 3 emissions:

Step 2: Calculating your total portfolio carbon emissions

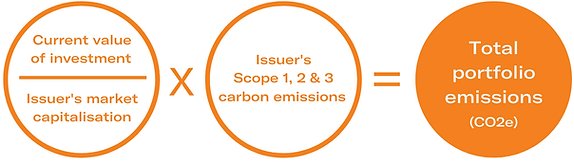

Total carbon emissions associated with a portfolio, expressed in tons of CO2e, are the proportional sum of the carbon emissions of each stock within an investment portfolio.

For example, if a stock represents 5% of a portfolio and its latest carbon footprint is 1.25 million metric tons, then its contribution to the portfolio carbon footprint is 5% of 1.25 million, or 62,500 metric tons. The equity contribution for each stock is added up to calculate the total portfolio carbon footprint.

This is a meaningful metric to track over time for investors who are specifically targeting emission reduction goals. This is because it provides a gauge of an investor’s responsibility for the emissions of each portfolio holding. However, this metric doesn’t allow portfolios to be compared on a like-for-like basis as portfolio size skews the results. As such, additional calculations are needed.

In the example below we calculate the total carbon emissions for a portfolio of three stocks. The carbon emissions of each stock’s portfolio weighting are added up in the portfolio carbon emissions column to a total of 6,933 tonnes. This represents the Scope 1 and 2 emissions this portfolio is responsible for. If we then include the Scope 3 component for each company, we have a total of 16,166 tonnes of financed carbon emissions.

Total portfolio emissions is a useful metric for investors who are comparing portfolios to identify which are the most carbon intensive, and vice versa.

Step 3: Calculating your portfolio carbon footprint

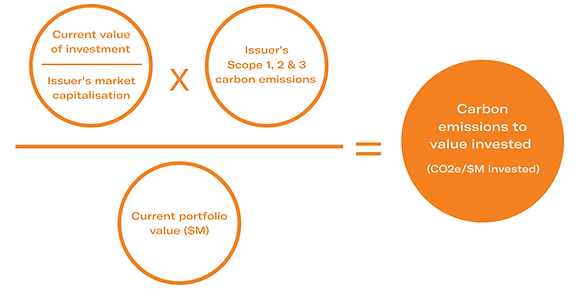

Your carbon footprint is the total carbon emissions for a portfolio normalised by the market value of the portfolio, expressed in tons CO2e / $M invested:

In the example below, we calculate the Carbon Emissions to Value Invested for the same portfolio of three stocks. In simple terms, it’s the Total Carbon Emissions calculation from above divided by the current portfolio value (in millions). The Carbon Emissions to Value Invested for each stock’s portfolio weighting are added up for the three stocks in the last column.

Step 4: Calculating your portfolio WACI

The Weighted-Average Carbon Intensity (WACI) is the portfolio’s exposure to carbon-intensive companies via revenue, expressed in tons CO2e / $M revenue.

It’s a popular portfolio metric because it’s a simple calculation which can be applied across asset classes as it doesn’t depend upon market cap or enterprise value as key inputs. It also provides a clear measure of a portfolio’s exposure to carbon-intensive companies and thus transition risks. But, it’s useful to keep in mind that there are downsides to using WACI that I have written about before here.

In the example below, we calculate the same portfolio’s Weighted Average Carbon Intensity by multiplying the portfolio weighting by each stock’s carbon intensity as a percentage of revenue. The Weighted Average Carbon Intensity for each stock’s portfolio weighting is added up for the three stocks in the last column. The total 2,694 tonnes CO2e/$M in revenue represents this portfolio’s weighted average carbon intensity.

What if I don’t have the data?

Data availability and quality are usually the biggest challenges when calculating a portfolio footprint.

If you only hold large cap index funds, you’ll probably find some data via company reports or existing data providers. But there’s always gaps, particularly for Scope 3 which can be 90% of the footprint for certain portfolios.

At Emmi, we’ve made it easy for you by building predictive models that give you emissions coverage across +40k equities.

What does the portfolio carbon footprint tell me?

Calculating your portfolio footprint is merely the first step in understanding carbon risk and opportunities for investors. Questions like:

- What warming scenario is my portfolio aligned with?

- Does my portfolio have material financial value at risk?

- What companies are the most important drag on this carbon risk?

- Do my portfolio company targets match up with committed targets?

- What can I do to reduce risk or seize on new opportunities?

These questions cannot be answered with a carbon footprint alone.

Many thanks,

Ben